SOLID FINANCES

“Inflation is a hot button issue”

The economist Stefan Kolev explains the current inflation as a consequence of the extended low-interest rate period combined with the COVID-19 pandemic and the war in Ukraine. His recommendation for the federal government: keep the “debt brake” engaged.

Interview: Maximilian Reinhardt

SOLID FINANCES

“Inflation is a hot button issue”

The economist Stefan Kolev explains the current inflation as a consequence of the extended low-interest rate period combined with the COVID-19 pandemic and the war in Ukraine. His recommendation for the federal government: keep the “debt brake” engaged.

Interview: Maximilian Reinhardt

Everyone is talking about inflation, but what is it really?

Most commonly, it is defined as the growth rate of a price index that is calculated by measuring the price development of a representative basket of goods over time.

And that figure indicates the general price development?

Well, the indicator isn't perfect; no indicator is. People whose purchases deviate significantly from the representative basket of goods feel misrepresented. Also, it is not only prices that evolve but technologies and the quality of goods, too. Let me give you an example: The technological properties and therefore the usefulness of mobile phones have changed quite fundamentally in the past 20 years. If the basket of goods wasn't adjusted from time to time, it would be a distorted representation of reality.

Why did prices in Germany go up so much last year? Everyone seems to agree that they did.

Some blame it on the ECB printing so much money, others on the supply shocks we witnessed during the past three years: the pandemic disrupted supply chains, which led to many goods being in short supply – and then there's the lack of Russian gas and crude oil after Russia's invasion of Ukraine, of course. You can even see those two causes as complementary: that line of reasoning has the expansive monetary policy as the powder keg and the supply crunches as the spark that sets it off.

Does that mean supply should be expanded?

Let's look at this from the other side: conventional wisdom is you need additional demand to get out of a global economic crisis. But both the pandemic and the war have curtailed the global supply of goods. In this situation, a higher demand will actually exacerbate the problem because of mounting price pressure. So, from a supply perspective the answer is: we need more production – ideally combined with capital investments in more efficient technologies and redoubled efforts to improve education and training. Because the shortage of skilled workers is already a very tight bottleneck.

Is there a connection between rising prices and the significantly higher lending rates?

Prices and interest rates are linked through a variety of channels. The link that is talked about most often is the central bank policy rate. Looking at the past 1.5 years, we can't help but notice that central banks, including the ECB, responded quite boldly.

What do you mean?

From a central bank's perspective, ending inflation is easy: raise interest rates strongly enough, and both investments and consumption, i.e. demand, will drop. If supply stays the same, inflation will go down. However, that can lead to a recession. In our case, this means central banks pushed back more strongly than many people, including me, had expected and raised interest rates quite substantially. Whether it is enough to tame inflation remains to be seen. Many loans still have negative real interest rates, because the inflation rate is still higher than the interest rates offered by many banks. In that case, banks get back less purchasing power than they lent out.

Stefan Kolev is professor of economics with a special focus on political economy at the University of Applied Sciences Zwickau. Since March 2023, he is the Academic Director at the Ludwig Erhard Forum for Economy and Society in Berlin.

Stefan Kolev is professor of economics with a special focus on political economy at the University of Applied Sciences Zwickau. Since March 2023, he is the Academic Director at the Ludwig Erhard Forum for Economy and Society in Berlin.

Can these new credit conditions be bad for the economy?

The question should rather be: haven't the very low interest rates been even worse for the economy? From a sustainability perspective it is hard to say. After a prolonged period of low interest rates it looked as if growth and prosperity were developing everywhere at first – which is true in part. However, when interest rates are that low, even inefficient companies and organisations survive. That ties up capacities that could have been more useful elsewhere. And it makes leaving the low-interest rate environment behind harder. Some business models and investments turn out to be unprofitable all of a sudden and collapse.

Would it make sense to revert to a more restrictive monetary policy?

Lenin is said to have declared that the best way to destroy the Bourgeois society was to lay waste to its monetary system. I grew up in 1990s Bulgaria in an environment of inflation and hyperinflation. I remember my parents being troubled by insecurity and concerns very vividly. That's why I know that the cost of inflation is not only economic. I support the restrictive monetary policy we are seeing right now. It must not be undermined by an expansive fiscal policy, though. The “debt brake” can make sure the government won't drive inflation even higher. An expansive fiscal policy would counteract the central banks’ efforts.

Maximilian Reinhardt is a consultant for economics and sustainability at the Liberales Institut within the Friedrich Naumann Foundation for Freedom.

Maximilian Reinhardt is a consultant for economics and sustainability at the Liberales Institut within the Friedrich Naumann Foundation for Freedom.

Also interesting

Karl-Heinz Paqué // Government is overextended

Germany will take in more than 1 trillion euros in taxes next year. And it still isn't enough. Or is it?

Jordi Razum // Europe is on the wrong track

Will the EU be able to succeed in the global subsidy race? Skilled labour, a leading science system and a solid infrastructure have made the single market a success story; no protectionism required.

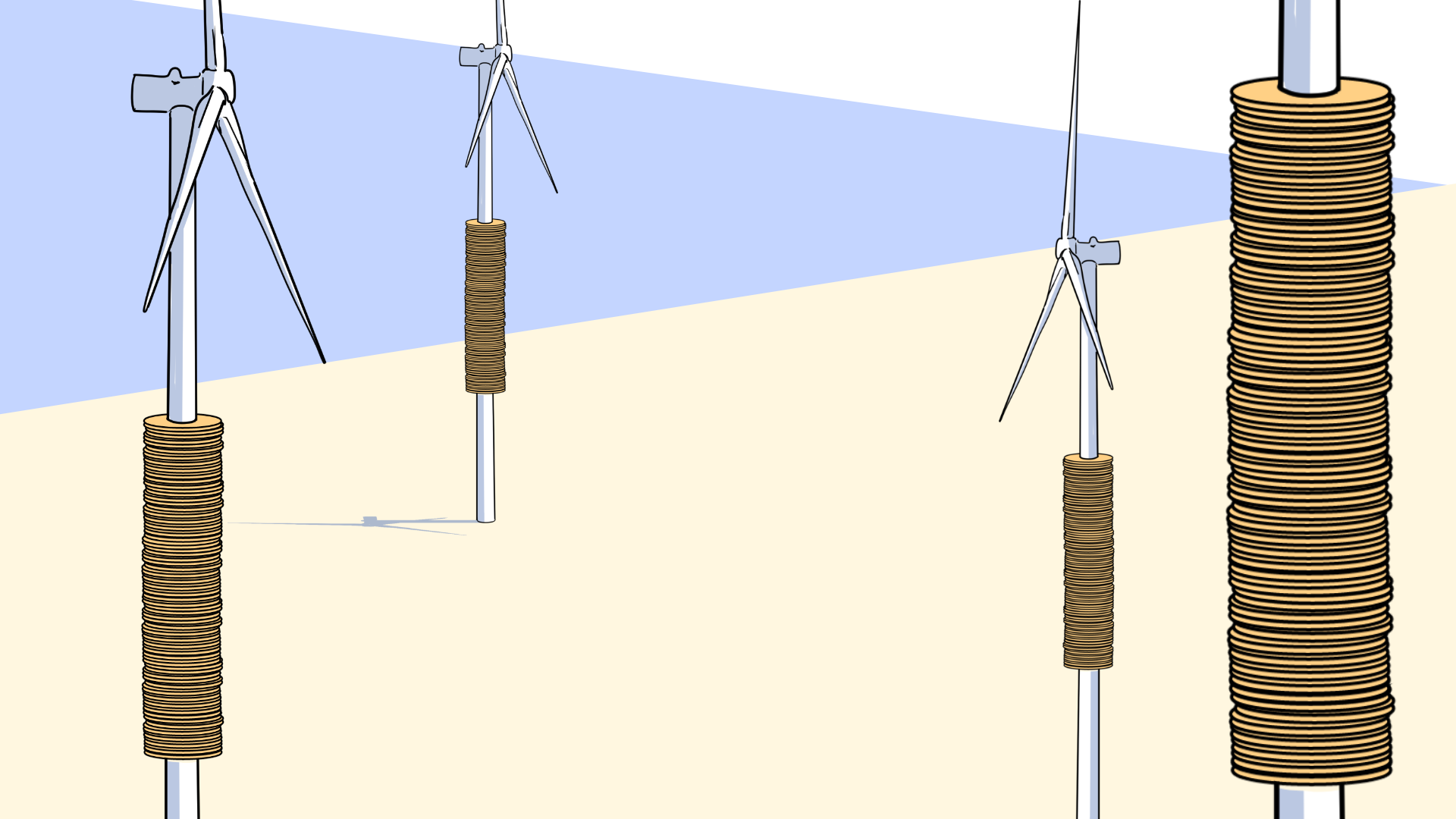

Fakten // A lot of money is spent on fossil energies

Organising a climate-friendly energy supply for the economy is a daunting endeavour. And yet, or maybe because of that, many countries across the world are still directly or indirectly subsidising fossil energies.